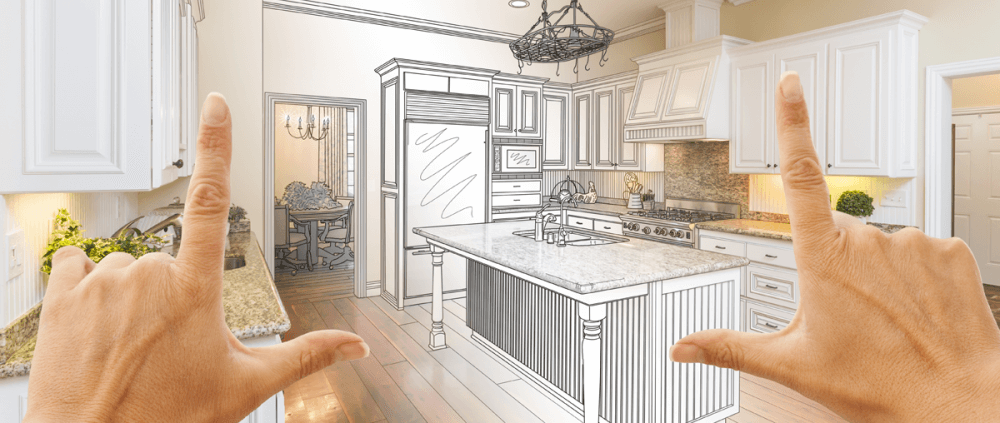

Home renovation mortgage loans are a great way for homeowners to finance their home renovation projects. These loans offer a great way to finance home improvements and repairs without having to take out a traditional loan. Home renovation mortgage loans are typically offered through a bank or other lending institution and can be used to finance the remodeling of a home, the addition of a new room, or even the purchase of a new home.

The first step to obtaining a home renovation mortgage loan is to find a lender who will provide you with favorable terms. It is important to do your research and compare lenders to get the best rate and terms. Once you have found a lender, you will need to provide information such as your credit score, income, and other financial details. The lender will then review your application and determine if they are willing to provide you with a loan.

Once you have been approved for a loan, you will then need to begin planning your renovation project. This will involve researching the costs associated with the renovation, such as materials and labor, and coming up with a budget. It is important to note that most lenders will require a down payment of at least 20% of the total cost of the renovation.

Once your renovation project is completed, your lender will then review the project and determine how much they are willing to finance. The amount will depend on the size of the project and the amount of money you are able to pay each month. In some cases, the lender may even be willing to provide a lower interest rate if you can demonstrate that you are able to make the payments on time.

Home renovation mortgage loans are a great way to finance your home improvement projects. They provide homeowners with the opportunity to remodel their homes and add value to their property. However, it is important to do your research and compare lenders to ensure you are getting the best rate and terms for your loan. Additionally, it is important to remember that the loan will need to be repaid over time, so it is important to establish a budget and stick to it.

Call or email me today for full Details.

Competitive Mortgage Rates. Trusted Mortgage Services.