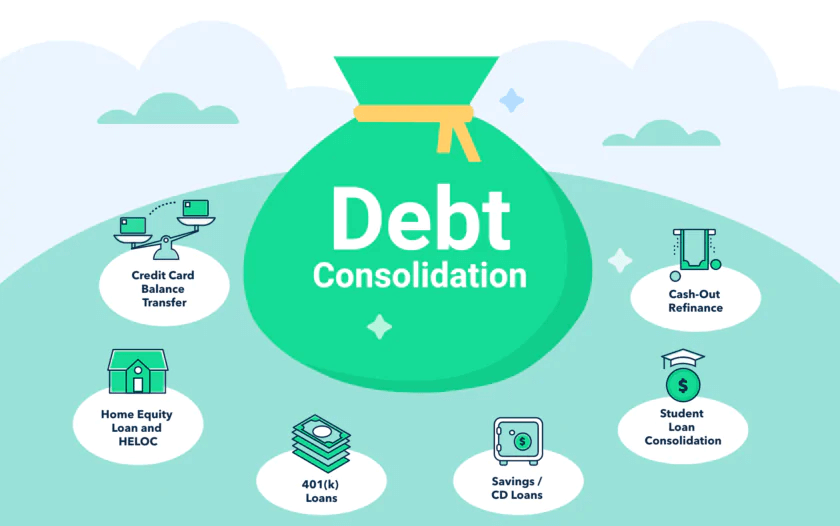

Debt consolidation is a popular and powerful financial tool used by millions of people worldwide to reduce their debt burden and improve their financial standing. In a nutshell, debt consolidation is the process of taking out one loan to pay off multiple other loans. This can be done with both secured and unsecured debts, and it offers several advantages to borrowers, including lower monthly payments, a longer repayment period, and a single monthly payment.

The first step in the process of debt consolidation is to assess your current financial situation. This includes determining the total amount of debt you have, the interest rates of each loan, and your overall financial goals. Once you have a clear understanding of your financial situation, you can then look for a loan that meets your needs. You may choose to get a consolidation loan from a bank, credit union, or online lender. These loans typically offer competitive interest rates and may also offer flexible repayment terms.

When you take out a consolidation loan, the lender will pay off all of your existing debts and replace them with a single loan with a single monthly payment. This allows borrowers to make a single payment each month, which can make it easier to manage their finances and keep their debt under control. Additionally, consolidating your debt can also help you improve your credit score, as it reduces the amount of debt you have and can help to demonstrate that you are able to effectively manage your finances.

When considering debt consolidation, it is important to carefully consider all of the available options. You should evaluate the interest rate and repayment terms offered by each lender and make sure that you understand the terms of the loan and the implications of making late payments or defaulting on the loan. It is also important to consider the impact of consolidating your debt on your overall financial situation.

Debt consolidation can be a great way to reduce your debt burden and improve your financial standing. However, it is important to carefully weigh all the options before taking out a loan and to make sure that you understand the implications of taking out a consolidation loan.

If you want to reduce your debt, Contact me today to review your options and immediately start saving money.

Competitive Mortgage Rates. Trusted Mortgage Services.