April 8, 2024 | Posted by: Devon Jones

The BOC increased interest rates from .25% to 5% between March 2022 and July 2023 to curb inflation, which peaked at 8.1% in June 2022. Despite the BOC's aggressive streak of rate hikes, which caused mortgage rates and other borrowing ...

read more

February 16, 2024 | Posted by: Devon Jones

In this article, Sunlite Mortgage will guide you through the essential things every first-time home buyer should know before making a significant home-buying decision. From understanding your budget and mortgage options to navigating the real estate market and negotiating the best ...

read more

17th August 2023 | Posted by: Sunlite Mortgage

When considering long-term investment options, the majority of Canadians are in agreement that homeownership proves to be beneficial. Nonetheless, this journey often comes with unexpected hurdles, including unforeseen financial obligations. Yet, the current scenario has led numerous homeowners to rethink their ...

read more

16th August 2023 | Posted by: Sunlite Mortgage

The resounding alarm bells are taking on the deafening tone of bull horns, echoing across Canada's real estate landscape. The critical issue at hand: the glaring inadequacy of housing supply to keep pace with the relentless surge in population growth. A ...

read more

May 4, 2022 | Posted by: Devon Jones

The Bank of Canada's first-ever account of its internal policy discussions reveals that senior management is divided over whether Canada's housing market would be more harmed by rising interest rates. The analysis the Bank of Canada used to decide whether ...

read more

28th July 2023 | Posted by: Sunlite Mortgage

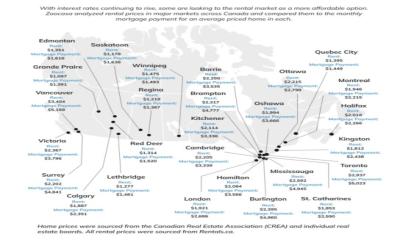

A recent study by Zoocasa reveals that the cost of renting versus buying comparable housing in select Canadian markets is equal. The difference between renting and buying was less than $500 per month in eleven different markets. However, the report ...

read more

25th July 2023 | Posted by: Sunlite Mortgage

The Greater Toronto Area (GTA) witnessed a significant surge in new home sales during June compared to the previous year. However, despite this impressive growth, the numbers still fell short of the 10-year average for the region. The Building Industry ...

read more

May 27, 2023 | Posted by: Devon Jones

As a homeowner, you may have heard of Home Equity Lines of Credit (HELOCs) and wondered if they are a good option for financing your next big purchase. HELOCs allow you to borrow against the equity in your home, which ...

read more

May 23, 2023 | Posted by: Devon Jones

In today's world, credit cards have become an essential part of our financial lives. They offer convenience and flexibility in making purchases and managing expenses. However, for many Ontarians, credit card debt has become a significant financial burden. In such ...

read more

May 20, 2023 | Posted by: Devon Jones

Introduction: Moving to a new country is an exciting adventure, but it often comes with financial challenges, especially when it comes to buying a home. For newcomers to Canada, securing a mortgage can seem like a daunting task. However, with ...

read more

March 11, 2023 | Posted by: Devon Jones

Taking out a second mortgage can be beneficial for many homeowners, as it can provide them with extra financial flexibility and allow them to increase their equity in the home faster. In this guide, we'll discuss the advantages of taking ...

read more

January 23, 2022 | Posted by: Devon Jones

There are two credit reporting agencies in Canada that provides credit scores – Equifax and TransUnion. Your credit or (Fico) score is made up of three-digit number that is calculated based on the information on your credit report. The number ...

read more

NOVEMBER 17, 2020 | Posted by: Devon Jones

Since the inception of the stress test the banks have continued to advance collateral charge mortgage but the readvancement has not been as easy. To get additional funds you will need to reapply and be approved based on credit, income ...

read more

NOVEMBER 17, 2020 | Posted by: Devon Jones

The overnight lending rate is the rate that banks lend and borrow money from each other. Any change in this rate will affect the commercial banks short-term lending rate i.e. consumer loans and variable rate mortgages. Prime rate Commercial banks set their ...

read more

NOVEMBER 17, 2020 | Posted by: Devon Jones

5 Mortgage-switch Surprises to Avoid If you’re thinking about shopping around for a cheaper mortgage, it’s important to understand the fine print before you make a move, or you could be surprised by fees and service changes that make your new ...

read more

NOVEMBER 17, 2020 | Posted by: Devon Jones

In October of 2016, the government prohibited refinances from being insured by the mortgage default insurers, CMHC, Genworth and Canada Guaranty if the mortgage risk was being increased. For various reasons refinances are regarded as an increased risk that could ...

read more

NOVEMBER 17, 2020 | Posted by: Devon Jones

The recent interest rate drop has created saving opportunities to home buyers and existing homeowners alike. Homeowners looking to refinance or renew a mortgage might want to act quickly if they want to take advantage of the price drop. That 0.75% ...

read more

NOVEMBER 17, 2020 | Posted by: Devon Jones

There are 5 factors that affect your credit score: Payment History 35% Utilization 30% Length of Credit History 15% Type of Credit products 10% Amount of Inquiry 10% There is a myth that if your credit is pulled more than once in a month your score ...

read more

NOVEMBER 17, 2020 | Posted by: Devon Jones

For borrowers whose mortgage come up for renewal they could be looking at lower rates if they know how to negotiate with their lender. Enlisting the services of a mortgage broker could pay dividends as in most cases they are ...

read more

NOVEMBER 17, 2020 | Posted by: Devon Jones

Most mortgage fraud is perpetrated using: Creating, sunlite mortgage or falsifying pay stubs, letters of employment and other documents; Giving misleading or inflated information about your income or length of service in your job; Misrepresenting your job status: full/part-time, hourly/salaried, commission-based or self-employed; Backdating ...

read more

NOVEMBER 17, 2020 | Posted by: Devon Jones

Graduates will now have no interest accruing on their loans during the 6 months grace period after they leave school. The RRSP home buyers plan withdrawal amount for first time home buyers has been increased from $25,000.00 to $35,000.00, and For households ...

read more

NOVEMBER 17, 2020 | Posted by: Devon Jones

What is a Construction Mortgage Loan A construction mortgage loan or construction financing loan is a short-term loan that attracts a higher interest rate than a regular mortgage. Here in Canada, there are three types of construction loans that people usually apply for are. ...

read more

NOVEMBER 17, 2020 | Posted by: Devon Jones

Lowest mortgage rates We consistently seek lower mortgage rates so that we can offer our borrowers the lowest mortgage rates in Canada. Compared to the the banks , we offer lower fixed mortgage rates, variable mortgage rates,HELOC mortgage rates, cash back ...

read more

NOVEMBER 17, 2020 | Posted by: Devon Jones

“Despite alarmist headlines, concerns about Canadian household debt levels can be overblown. When looking at debt levels it’s important to consider the degree to which Canadians are also using it to increase their net worth,” said Livio Di Matteo, a ...

read more

| Posted by:

Credit Report vs. Credit Score To start with, it’s important to understand that your credit report and your credit score are two separate things. Credit Report Your credit report contains detailed information about your credit history. Sources include lenders, utility companies and landlords. ...

read more

NOVEMBER 17, 2020 | Posted by: Devon Jones

Not combining high-interest debt into a low-interest mortgage This can include credit or car loans. Often homeowners don’t want to use the equity from their home or want to pay off the debt. Normally debt occurs because of inefficient budgeting or ...

read more

NOVEMBER 17, 2020 | Posted by: Devon Jones

Enter in a CHIP Reverse Mortgage! For those of you who don’t what a Reverse Mortgage is, it’s basically a simple and sensible way to access the value of your home’s equity and turn it into cash. This way, you can ...

read more

NOVEMBER 17, 2020 | Posted by: Devon Jones

Common Questions about the Spousal Buyout Program: Is a finalized separation agreement required? Yes. In order to qualify, you will be required to provide the lender with a copy of the signed separation agreement. The details of asset allocation must be clearly ...

read more

NOVEMBER 17, 2020 | Posted by: Devon Jones

Mortgage Renewals Mortgages are amortized (over a set term) which can vary from 1-30 years and the longer the amortization the lower the monthly mortgage payment. About 6 months before the end of your term, your current lender will want to retain ...

read more

NOVEMBER 17, 2020 | Posted by: Devon Jones

What is a Consumer Proposal? A consumer proposal is a legal agreement (and an sunlite mortgage native to a bankruptcy) between a debtor and his or her creditors when the debtor cannot afford to pay the creditors. In this process, the ...

read more

NOVEMBER 17, 2020 | Posted by: Devon Jones

These transactions have gotten more difficult since Office of the Superintendent of Financial Institutions (OFSI) recently introduced a new stress test for home buyers or home owners whose equity is 20% or more and don’t need mortgage default insurance. Most mortgage ...

read more

NOVEMBER 17, 2020 | Posted by: Devon Jones

Service While Mortgage Processing: A mortgage agent provides some service that is similar to a bank, but most mortgage agents work after business hours. Because mortgage agents and brokers are self-employed, they spend hours honing their skills and developing referral sources. You ...

read more

NOVEMBER 17, 2020 | Posted by: Devon Jones

The bank has said that since the United States, Mexico and Canada Agreement (USMA) has now been negotiated, the expectation is that trade uncertainty will be reduced. The noted though that they still have some concerns about the US-China tensions. They ...

read more

NOVEMBER 17, 2020 | Posted by: Devon Jones

There are many reasons that people file a proposal. A recent survey shows that the top three causes for a consumer proposal in Canada are as follows: Unemployment or income issues 09% Health issues 01% Relationship breakdown 97% If you have been hiding from or avoiding calls ...

read more

NOVEMBER 17, 2020 | Posted by: Devon Jones

The new data provided the latest evidence that steps taken at federal, provincial and municipal levels have begun to temper the country’s real estate sector, particularly in the Vancouver and Toronto regions. “What we’ve put in place has had some impact ...

read more

NOVEMBER 17, 2020 | Posted by: Devon Jones

As part of the mortgage approval process, your mortgage broker will ask for documents that show proof of your income, down payment and other items such as proof of permanent residency and other identification. A mortgage fraud occurs when an applicant ...

read more

NOVEMBER 17, 2020 | Posted by: Devon Jones

Finance Minister Bill Morneau announced a series of new mortgage rules, including more stringent “stress testing” for borrowers who take out insured mortgages and rules aimed at mortgages with high down payments. In an interview, Mr. Morneau said the new measures ...

read more

NOVEMBER 17, 2020 | Posted by: Devon Jones

For some, protecting assets they have accumulated over their lifetime is equally important and so they will require insurance of a different nature for a tax strategy. For others, it might be to ensure a key business person or to ...

read more

NOVEMBER 17, 2020 | Posted by: Devon Jones

Full-time positions rose 81,300 in December from the previous month, the biggest gain since March 2012, and even after taking away 27,600 part-time jobs, the total employment gain of 53,700 shattered the economist forecasts for a small decline. For 2016 as ...

read more

NOVEMBER 17, 2020 | Posted by: Devon Jones

1. Do you feel bogged down by little payments? Consider refinancing your mortgage to include all the little payments such as credit cards and smaller loans. Your overall monthly payment obligations can drop significantly which in turn frees up your cash ...

read more

NOVEMBER 17, 2020 | Posted by: Devon Jones

The fear of missing out Due to higher property values coupled with recent changes in borrowing rules, home buyers think the dream of home ownership is harder. This could be a factor in the spike in mortgage fraud. Mortgage rules mandates ...

read more

NOVEMBER 17, 2020 | Posted by: Devon Jones

Lowest mortgage rates We consistently seek lower mortgage rates so that we can offer our borrowers the lowest mortgage rates in Canada. Compared to the banks, we offer lower fixed mortgage rates, variable mortgage rates, HELOC mortgage rates, cashback mortgage rates ...

read more

NOVEMBER 17, 2020 | Posted by: Devon Jones

Completing a mortgage pre-qualification from a mortgage broker takes about one to five minutes. Canadian mortgage brokers have access to multiple lenders and should be your first choice rather than going to the lenders directly. They would be able to assess your ...

read more

NOVEMBER 17, 2020 | Posted by: Devon Jones

Here is our free, easy, step-by-step guide on Step 1: Figure Out Where You Want to Buy Your First Home For some people buying your first home may mean buying a fixer-upper and doing the renovation to make it the home you ...

read more

NOVEMBER 17, 2020 | Posted by: Devon Jones

The Incentive has an equity-like payout, where the government would share in the upside and downside of the property value. The First-Time Home Buyer Incentive launches September 2, 2019*. * Barring any unforeseen circumstances the program will launch on September 2, 2019. ...

read more

NOVEMBER 17, 2020 | Posted by: Devon Jones

Mortgage Agents in Parry Sound If you are refinancing your mortgage in Muskoka (Bala, Bracebridge, Burk’s Fall, Gravenhurst, Haliburton, Kilworthy, Minden, Parry Sound, Port Loring, and Wilberforce) and you need to have an experienced mortgage agent with access to many mortgage lenders ...

read more

NOVEMBER 17, 2020 | Posted by: Devon Jones

Contact your Sunlite Mortgage Oshawa mortgage agent today. ...

read more

NOVEMBER 17, 2020 | Posted by: Devon Jones

We are paid by the banks, credit unions and trust companies for placing your mortgage with them, in some case at lower rates. In very rare cases you will ever have to pay a fee. Contact your Sunlite Mortgage London mortgage ...

read more

Competitive Mortgage Rates. Trusted Mortgage Services.