Committed to making your mortgage approval process stress free and efficient for over 25 years, Sunlite Mortgage is one of Toronto, Canada’s leading mortgage brokerages.

Your credit score gives mortgage lenders a window into your overall financial health and helps them determine what mortgage products you qualify for, if any. Ranging from 300 to over 900, your score will determine some of your biggest financial milestones, including the interest rate you will pay on your mortgage, applying for a rental property, loans, and credit cards. The lower your credit score the higher your mortgage rate (if you qualify) and the higher your credit score, the lower your rate historically.

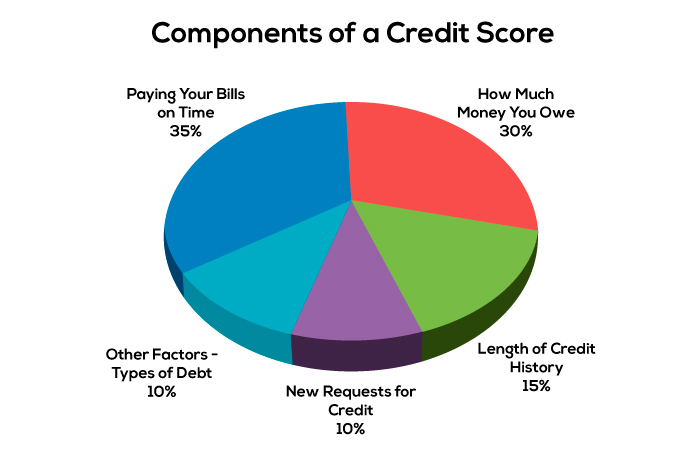

Mortgage lenders always want to see that you have consistently paid your bills on time. Creditors and lenders want to know that you are trustworthy and can pay back the funds that have been loaned to you. Since this is one of the greatest predictors that you are likely to be financially responsible, it is a very important factor in calculating your credit score.

In fact, the length of time it takes you to pay your bills affects your credit score more than any other factor. Serious payment issues such as bankruptcy, tax liens, foreclosures or a repossession can demolish your credit score, ensuring that it will be impossible for you to get approved for anything in the future.

Mortgage lenders and creditors will want to see a lower ratio of how much debt you’re carrying compared to how much available credit you have, which is also known as credit utilization. If your balances are high relative to your total available credit limit, for example, if all your credit cards are near their limit, it could be a red flag to a lender, and indicate that you may have too much debt.

As a rule, you should keep your credit card usage at 30% or less. You don’t need to have a $0 balance on your accounts; while less is characteristically better, owing small payable sums can be better than owing nothing, because lenders want to see that you are responsible and financially stable enough to pay back any money you’ve borrowed. Conversely, your credit score can quickly improve if you pay down your balances in a timely manner.

Most credit scoring models generally look at the mix of different types of credit accounts you have, such as credit cards, mortgages and installment loans. If you have too many credit accounts, or not enough of a different mix of credit products, it could negatively impact your score.

There are two basic types of credit accounts: installment loans and revolving accounts; having both types on your credit report helps your credit score because it indicates that you can successfully manage different credit types. Having loans for different assets (home, car, etc.) will help diversify your portfolio even more, but don’t open new accounts for the sake of variety.

While this sounds counterintuitive based on component #3, be careful not to have too many accounts at once. Credit scoring models will consider how many new accounts you’ve acquired within a 12-month period. Having too many indicates to lenders that you’re taking on a lot of new debt and may consider you to be high-risk.

Every time you submit a new application requiring a credit check, an inquiry is placed on your credit report. Lenders will run a hard inquiry, or “hard pull”, as opposed to a soft inquiry, such as when you check your own credit history, and will not affect your score. Several hard inquiries can deduct a lot of points, so try to keep your applications to a minimum. It’s also important to note that your inquiries will disappear from your credit report after 24 months.

Lenders want to see that you can handle your credit accounts properly over time. Credit accounts with a longer history showing responsible credit behavior will reflect positively on your credit score. Newer accounts will lower your average account age, which could negatively impact your score.

The age of your credit accounts considers the age of your oldest account and the average age of all your accounts. Long credit history can be helpful, if it hasn’t been impacted by a pattern of late payments or other negative factors.

Financial experts recommend leaving your credit card accounts open, even if you don’t use them; the age of those accounts by themselves will help boost your score. The age of your credit is also another reason why it’s not a good idea to open several new accounts at once.

How you handle the construction of your credit score shows lenders your history of financial stability and responsible credit management. Making wise, long-term financial decisions can help you build and protect your score for years to come.

How you handle the construction of your credit score shows lenders your history of financial stability and responsible credit management. Making wise, long-term financial decisions can help you build and protect your score for years to come.

For help in understanding how your FICO score affect your mortgage please contact a Sunlite Mortgage Agent.